Smarter Customer Communication for AI Voicebot Solutions for Banks and Insurancecompanies

Abstract: Language barriers, poor customer satisfaction, and ineffective customer service have always been major problems for financial institutions and insurance companies. The conventional manual service model has not been able to satisfy real needs, from simple business processing to complicated complaint handling. Instadesk Voice Bot has now precisely offered a solution: by utilizing AI technology to create a 24-hour uninterrupted service system, it not only eliminates the awkward "service interruption" scenario but also handles a significant amount of repetitive work. It greatly lessens the strain on human resources while also giving financial firms and insurance companies a powerful boost to improve their services and undergo digital transformation.This article will provide you with ai voicebot solutions for banks and insurancecompanies.

I. Pain Points and Challenges Faced by Financial Industry Customer Service

1. Low service efficiency, affecting customer experience

The volume of daily customer consultations at the customer service center is high, regardless of whether it is a bank, insurance company, or securities institution. The traditional manual service model is vulnerable to a labor shortage during periods of high business activity. Customers typically have to wait a long time—in certain cases, several minutes. In addition to negatively impacting the customer experience, this could result in an increase in complaints. Prior to the implementation of intelligent customer service, the average wait time for customer inquiries was up to five minutes, which is significantly longer than what customers would consider acceptable, according to data from a joint-stock bank.

2. High labor costs, significant operational pressure

It is challenging for businesses to strike a balance between the assurance of service quality and cost control because of the high cost investment in the manual customer service component, which includes hiring, training, and other aspects. Additionally, customer service employees are highly mobile. The lack of customer service personnel is particularly noticeable during off-peak hours, and failing to ly address customer questions not only erodes users' confidence in the organization but also raises compliance risks because of service delays, which could result in losses for the business.

3. Insufficient long-tail customer service, potential value not fully exploited

In the financial and insurance industries, up to 85% of long-tail customers fail to receive effective service support. On one hand, the cost of reaching such customers through online channels such as apps is high; on the other hand, the staff at offline branches are already overwhelmed with their daily workload and have no time to address the needs of long-tail customers. As a result, the operational costs at the grassroots level have not been effectively reduced, and the potential value of long-tail customers has not been fully exploited, leading to waste of resources and, in turn, harming the economic benefits of the enterprise.

II. Instadesk Voice Bot Targets and Solves Customer Service Pain Points in the Financial Industry

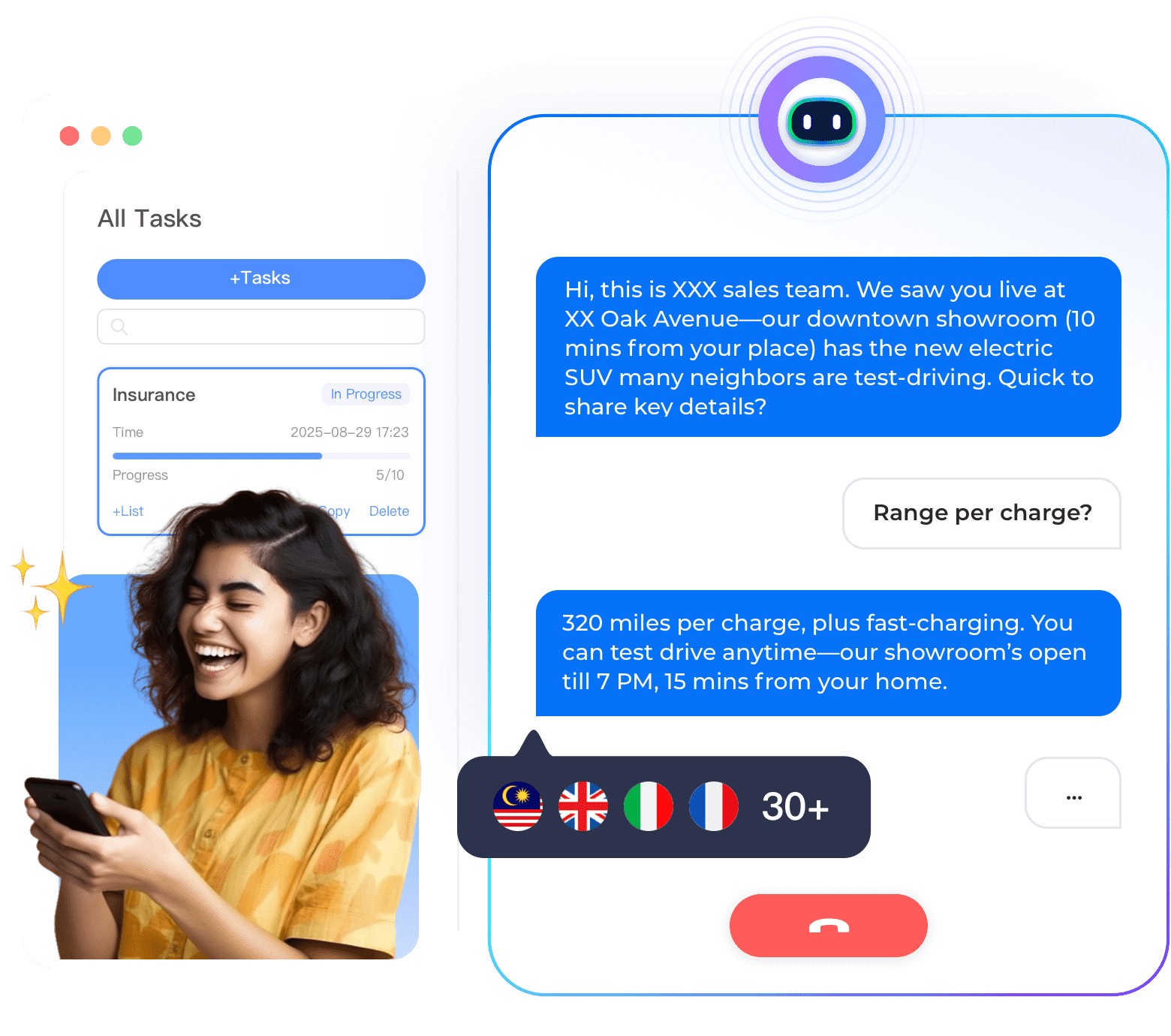

In response to the aforementioned industry pain points, Instadesk Voice Bot is providing comprehensive solutions. Leveraging AI technology, the system can offer 24/7 efficient services, effectively alleviating the pressure on human staff and enhancing the efficiency of customer service in financial institutions and insurance companies.

1. Full-scenario coverage, suitable for all stages of financial services

The only full-stack intelligent customer support product in the market is Instadesk Voice Bot 4.0. Multimedia contact centers, voice and text robots, intelligent workstations, intelligent practice assistants, intelligent quality inspection tools, and more are all included in this comprehensive intelligent customer service product system. To guarantee continuous service, the system uses a "AI priority + human backup" service model. AI is capable of handling more than 80% of common issues, including balance inquiries, on its own at night or during busy business hours. The system will smoothly transfer complex issues to human agents while concurrently pushing the customer's past consultation records and suggested scripts, cutting down on communication steps and expenses.

2. Intelligent form-filling function, improving information collection efficiency

When opening an account and applying for a loan, for example, clients must fill out a lot of information. In addition to being ineffective, the conventional manual inquiry method is prone to information errors. Based on the content of the conversation, such as credit card applications, Instadesk Voice Bot can automatically determine the type of work order and intelligently fill in pertinent fields. For instance, the system will automatically classify a customer as a "high-net-worth customer" and suggest appropriate financial products when they mention "annual income of 500,000." It will also automatically enter the income information into the work order, saving the agent from having to repeat inquiries and greatly increasing business processing efficiency.

3. Agent assistance function, facilitating efficient communication

Financial business and insurance industries involve complex terms and strict compliance requirements. Newly hired agents often have low communication efficiency due to insufficient experience. Instadesk Voice Bot's real-time translation function can convert customers' colloquial expressions into standard business terms, such as converting "Is the interest high?" into "Annualized yield range"; meanwhile, the system uses emotion recognition technology to determine the customer's attitude and ly push appropriate response scripts. That’s why ai voicebot solutions for banks and insurancecompanies. When a customer shows dissatisfaction due to long waiting time, the system will immediately the agent: "The customer is agitated, suggest apologizing first and providing a compensation plan", helping the agent ly soothe the customer's emotions and prevent conflicts from escalating.

4. Efficient interception and precise diversion, focusing on high-value services

The interception capability of Instadesk Voice Bot is outstanding, with an interception rate exceeding 90%. It can independently handle most common problems and simple inquiries, freeing up the human agents from repetitive tasks and enabling them to focus on complex and high-value customer services.

The system automatically assigns tasks based on the complexity of the problem: simple issues (such as password reset) are handled directly by AI; medium-level problems (such as financial recommendations) are generated by AI and executed after being ed by human staff; high-level problems (such as complaint disputes) are immediately transferred to senior agents. This hierarchical processing model not only ensures service efficiency but also improves the quality of high-value business services.

5. Financial-level security compliance, ensuring data security

The insurance and financial sectors have very strict standards for data security and compliance. From the outset of its design, Instadesk Voice Bot integrates financial-level security standards, offering complete protection for data security and compliant operations.

The system employs end-to-end encrypted transmission for data security and privacy protection. Private servers are used to store customer data, which is encrypted using the most advanced algorithms. Using

The middle digits of the customer's ID number and bank account number can be automatically hidden by the system's built-in sensitive information anonymization feature at that point, guaranteeing that the conversation logs adhere to legal requirements.

Regarding compliance, the system features an integrated compliance knowledge base that is updated instantly with regulatory guidelines pertaining to the

In terms of compliance, the system has an in-built compliance knowledge base that is updated in real time with regulatory policies regarding the country where the business is conducted, ensuring that the customer's language and operation procedures are 100% compliant. Moreover, all conversation records can be traced and audited, meeting the requirements for regulatory inspections.

IV. Instadesk Voice Bot Facilitates Financial Digital Transformation

The future of financial services will move towards a more intelligent, efficient, and humanized direction. Intelligent customer service is no longer merely a tool for improving service efficiency; it is also a key support for financial institutions to achieve digital transformation and enhance their core competitiveness.This represents a challenge for the future, and at the same time, it is an opportunity for future intelligent voice service robots. The ai voicebot solutions for banks and insurancecompanies.

Instadesk Voice Bot is built based on advanced technologies such as large models. With its profound experience and technical advantages in the financial and insurance industries, it has helped numerous banks, insurance companies, and securities institutions upgrade their customer service. If you are facing problems such as low customer service efficiency, high labor costs, and poor service experience, you might want to try Instadesk Voice Bot. Experience the changes brought by intelligent services and provide a new path for upgrading the customer service part of your enterprise. Meanwhile, through excellent performance and functions that are in line with the actual needs of the enterprise, the ai voicebot solutions for banks and insurancecompanies

Issac

Omnichannel Digital Operations: Driving Traffic Growth & Deepening User Value

You may also like

Best VoiceBot Platforms Tools in 2026: comparison

When enterprise Search for the Best VoiceBot,what they really want to figure out is not which platform ranks first in the number of functions. In fact, these people want to know which platform can really support large-scale practical business. In this place in Southeast Asia.

Can a Voice Bot Sound Local and Personal

Enterprises expanding globally face the challenge of connecting with overseas customers authentically. The key lies in a solution that blends cultural adaptability with human-like interaction—and Instadesk ai voicebot is exactly the right choice.

How Voice Bot Helps Enterprises Close the Loop from Beginning to End in Manufacturing

In the manufacturing sector, customer engagement often spans from initial inquiry to post-delivery support. Closing this loop efficiently is critical for maintaining competitive advantage. Instadesk Voice Bot empowers manufacturing enterprises to integrate marketing, sales, and service into a seamless workflow.

Get Started in Minutes. Experience the Difference.